Stock trading, from a long time now, has always been considered as one of the most complex and perhaps risky endeavors that are far better left to the large brokerage houses or… the moneyed people of the nation. This is true to an extent, but the world of digitization has opened a new way where equality is given in terms where everyone starts their financial freedom.

In today’s world, where one can decide to work remotely too, one can choose from thousands of applications and websites that provide ‘mainstream’ tools that help anyone who wants – a beginner or a large investor – make money properly, with appropriate knowledge, planning, and support from experts.

Let’s take a look at the top collaborative investment applications and websites, including their distinctive features, capabilities, and potential for both rookie and seasoned investors.

And if you’re seeking a structured pathway to unraveling the world of investments, look no further than Quantum AI website. This website is dedicated to bridging the gap between eager learners and investment education, without indulging in direct investing advice. Its primary goal is to connect those interested in investing with educational institutions that can lead them through their learning experience!

Now, on to the list!

1. Fidelity

Fidelity offers hundreds of stock, mutual fund, ETFs, bond selections and other investments; the favorite of customers due to an easy to navigate Website and many tools, including 15 calculators and real-time quotes. Another feature of Fidelity is the possibility to choose between many managed and self-managed medical expense accounts variable and fixed, recommended for investors independently or by the company on the basis of suitable for novices and experienced investors.

Although it also has many other enticing offers that are exclusively for its consumers, that particular company specifically specializes in the digital estate plan that assists in the protection and passing on of wealth to your loved ones. Besides, the trading commission which was not observed in the platform ensure the individual of another source through which they can make maximum profits The team of professional traders in the respective areas of stock trading also helps the individual in acquiring adequate knowledge on how to succeed in stock trading businesses from the teaming professional traders in the relevant fields of stock trading.

2. Robinhood

Robinhood has grown into a phenomenon in the realm of investment, reshaping upon its entrance the concept of wealth creation for millions of Americans. Since its aim is to bring Accessibility in the conventional investment, this app has erased the hoods in the nature common with monstrously expensive apps, where users can invest with as much as one dollar.

Because of the two funds’ collaborative design, users have access to more than 1,700 stocks researched extensively for easier decision making based on retrieved data and analyses. Besides, the opportunity to invest in cryptocurrencies also falls within the app’s framework, which opens the door to the vast world of digital assets in your investment arsenal.

3. Invstr

Should you be experiencing minimal capital investment for the first time or if you are new in investment, Invstr is that suitable investment app to mentor you. Through the user-friendly design and no-commission purchases, this tool eliminates the scary stuff, letting you try the possibilities without investing a lot of money.

The customized portfolios on Invstr are easy to create and constructed with the support of in-built professional advisers for one’s individual goals and level of risk. Whether you are targeting to trade U. S. stocks and ETFs or exploring to try fractional shares and cryptocurrencies, with Invstr you are going to enjoy your investing experience and witness your portfolios’ performance.

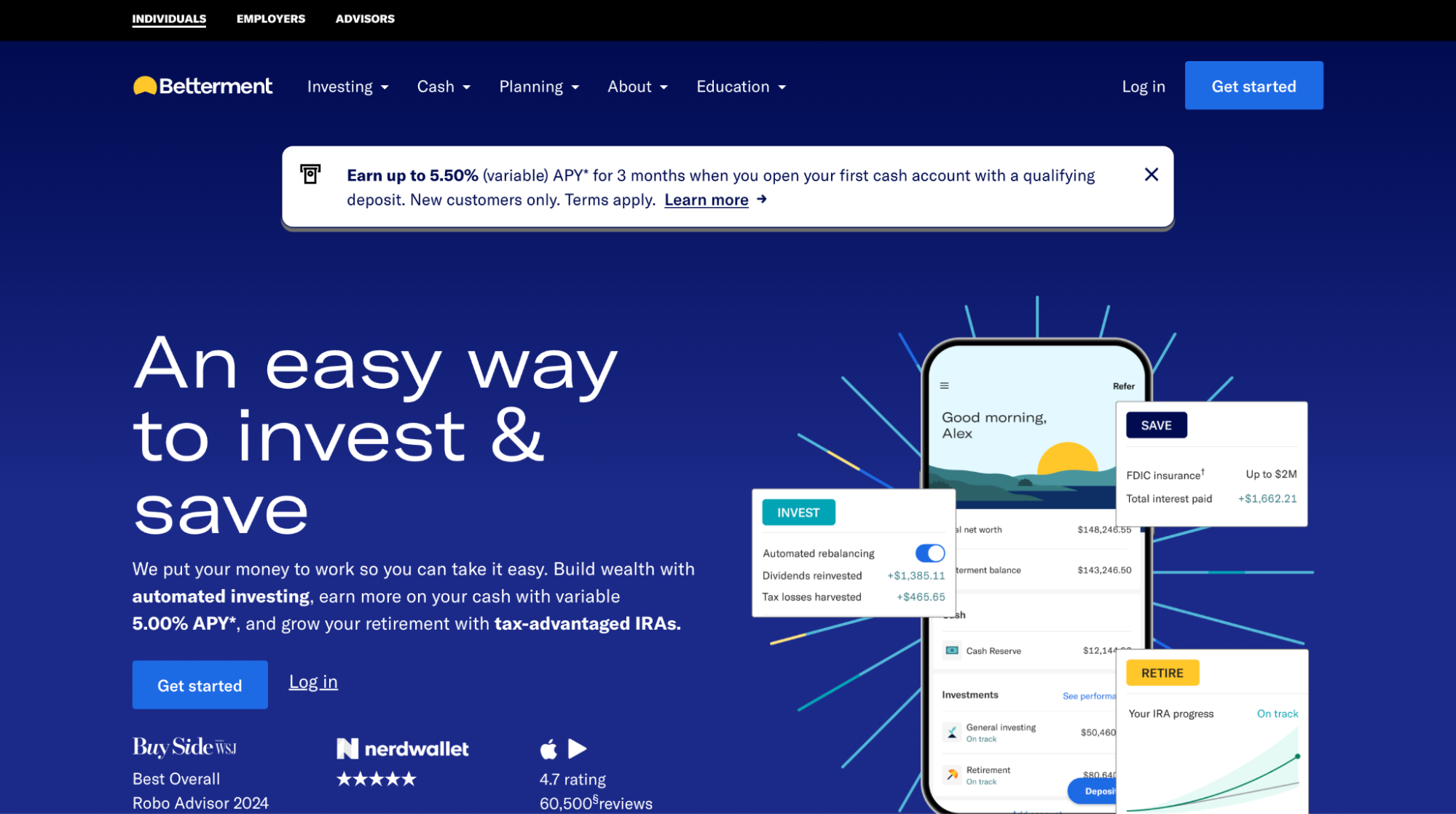

4. Betterment

If moving towards a collaborative investment app user environment is the way to go, then Betterment should be regarded as a pioneer of such an interface, featuring an utterly convenient investment solution enhanced by modern technologies. Betterment is well-known as one of the biggest percentiles of robo-advisors and controls your funds very efficiently, adjusting them for your level of risk and preferences in receiving income.

If you want to invest in climate change and socially responsible investments then you might want to give Betterment a shot. In representing the company’s and your ethical standpoint, it is good for both you and the potential generations as it contributes to the formation of a sustainable environment. Betterment currently provides a strong offering in cash management, combined with specialized features for goal setting; overall, this enables you to have a professionally-managed portfolio at a low cost.

5. Acorns

Acorns savings application has perfectly positioned itself as one of the most popular ones for a reason. This simplicity-free solution relieves the rather cumbersome process of saving and investing from the burden of being complicated; through this platform, users can automate the process of investment, do dividend reinvestment, meaning that, from this platform, you can be assured of your wealth increasing, through investments, consistently.

They also provide round-up investment functionality where Acorns rounds up users’ purchases to the nearest dollar and invests the additional change into a portfolio of ETFs. What sets it apart from other more traditional types of investment is that this method is highly integrated into what you are already doing in your daily life and there is no initial hefty capital required. Also, Acorns has offered specific investment plans for the family where you can open an investment account for your children/ Stock-Back® for debit products to make sure that the whole family is on the right track to accumulating wealth.

6. Charles Schwab

This is an investment app that offers financial advice for mutual funds to new, moderate, and advance-level investors. It is most notable for their extensive database of research and education materials; they provide a wealth of actionable information for people wishing to improve their financial literacy on finance and investing.

With regards to the criteria that value different approaches to commission- and fee-based trading services, US low-cost brokerage firm Charles Schwab still provides such options as fractional shares as well as commission-free trading for stocks and ETFs that enables investors to invest every single dollar that he or she earned into the securities of one’s’ preference. Moreover, the account has a feature whereby the clients are offered a cash bonus on behalf of the platform provided that a certain minimum amount is funded on the account: an added incentive for anyone who wishes to commence their investment.

7. J.P. Morgan Self-Directed Investing

For those who are searching for the no-frills, yet quite satisfactory brokerage firm, the J. P. Morgan is a suitable choice. This investment platform is for users to invest with other people and in addition it offers a multitude of Morningstar and CFRA research tools and other researching materials.

With equal efficacy, Self-Directed Investing Portfolio Builder effectively contributes to construction of a powerful and efficient portfolio with no impediment. The no-commission model, the convenient opportunity to link all the Chase accounts enhancing spending and saving experience like the mentioned by W. L. Silvester option contributes to the demand for this service. Hence, both the new investors and the experienced ones may get benefits with the offers that J. P. Morgan Self-Directed Investing offers its consumers.

8. M1 Finance

M1 Finance is a feature-rich money management software that appeals to both self-directed traders and those looking for automated investing solutions. It offers a wide range of services. From fractional shares and commission-free trading in stocks, ETFs, and cryptocurrencies, to user-friendly interfaces and expert-designed portfolios, M1 Finance has something for every investor.

One of the standout features of this collaborative investment platform is its ability to balance multiple financial needs. Whether you’re seeking hands-on trading experience or prefer to let the experts handle the heavy lifting, M1 Finance provides a seamless solution. With low minimum deposit requirements and no extra fees for standard accounts, this platform empowers you to take control of your financial future without breaking the bank.

9. Ellevest

While Ellevest started with the mission of closing the gender gap in investing, it has since evolved into a platform that welcomes and empowers individuals of all backgrounds, including non-binary and gender non-conforming individuals. This collaborative investment app is a true game-changer for those seeking personalized plans for individual investment and retirement accounts.

With automated IRA and 401(k)/403(b) rollovers, as well as one-on-one sessions with certified financial planners, Ellevest offers a comprehensive suite of services tailored to your unique needs. Furthermore, the personalized suggestions provided by the platform, which are derived from longevity data and gender-specific wage curves, guarantee that your investments are geared towards long-term financial security and growth.

Conclusion

In the ever-evolving world of investing, the best collaborative apps and websites have emerged as game-changers, democratizing access to wealth-building opportunities and fostering a supportive community of investors. From user-friendly interfaces and comprehensive educational resources to advanced trading tools and real-time market insights, these platforms cater to the diverse needs of investors at every level.

Whether you’re a seasoned investor seeking advanced trading tools or a newcomer looking to dip your toes into the waters, the collaborative investment landscape offers a wealth of opportunities to grow your wealth, learn from others, and stay ahead of the curve.

So, embrace the power of collaboration, engage with like-minded individuals, and let these best collaborative investment apps and websites be your trusted companions on the path to financial freedom.